Previous slide

Next slide

Free Consultation

For all services

Maximum Tax Saving

With the help of our Experts

Speedy Process

Expert services reduces

process time

Accurate Compliance

Experienced Team with

multiple verification

Data Privacy

Best practices for Data Security & Privacy

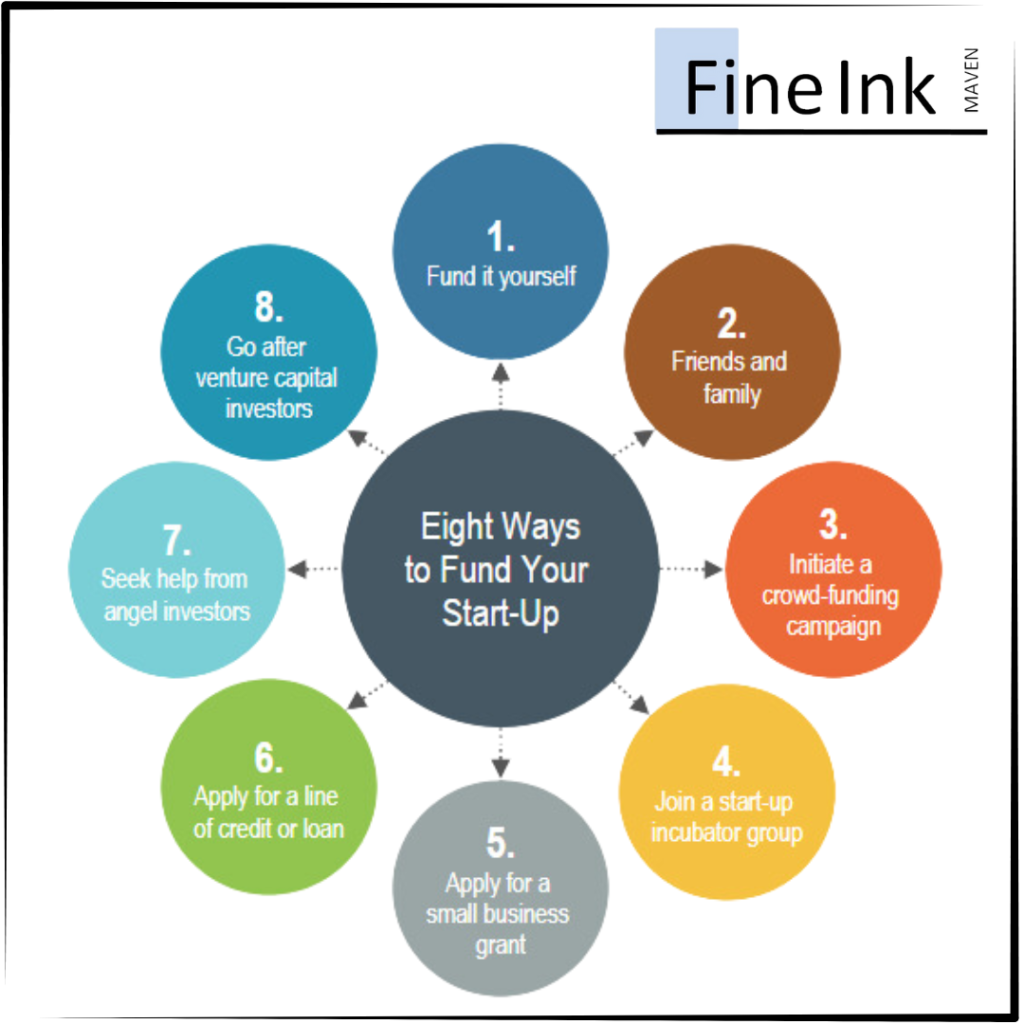

Startup’s FM Strategies

In the startup world, effective financial management is essential for strategic decisions and growth. Proactive budgeting, cash flow monitoring, and leveraging technology are key. Prioritizing profitability, diversifying revenue, and assembling a skilled financial team are crucial. Survival depends on navigating with wisdom amidst uncertainty, not just strength or speed.

Navigating the E-Way Bill System

The E-Way Bill system under GST is a digital document required for goods movement above ₹50,000. It ensures tax compliance, transparency, and traceability in supply chains. Compliance, integration with ERP systems, collaboration with transporters, and vigilance are vital for businesses to navigate this regulatory landscape effectively.

TDS on Property Purchase

Navigating TDS on property purchase is crucial for buyers. Governed by Section 194-IA of the Income Tax Act, 1961, TDS is applicable when the property's consideration exceeds Rs. 50 lakhs. Buyers must deduct 1% of the total consideration and deposit it with the government to ensure compliance and avoid penalties.

Filing of Income Tax Return

Navigating income tax filing in India can be complex. Ensure you have all necessary documents like Form 16 and investment proofs. Select the appropriate ITR form, report income accurately, and claim eligible deductions. Verify details before submission to avoid penalties. Seek assistance from tax professionals for a smooth filing process.